Swedish Treyd aims to become the world's largest provider of short-term credit for retail.

Swedish fintech rocket enters Norway

While Treyd offers a single, fairly straightforward financing solution – paying suppliers upfront and letting companies pay back a few months later – customers have reported benefitting from it in a variety of ways.

Improving liquidity by freeing up working capital from the supply chain might be the ‘obvious’ use case, but it’s not the biggest draw for several of the companies that have ended up choosing to use Treyd.

So, what’s the main benefit of using Treyd to finance your inventory purchases? The answer tends to vary depending on who we ask. Here are some top ‘wins’ customers have reported as a result of using Treyd. Starting with the ‘obvious’ one…

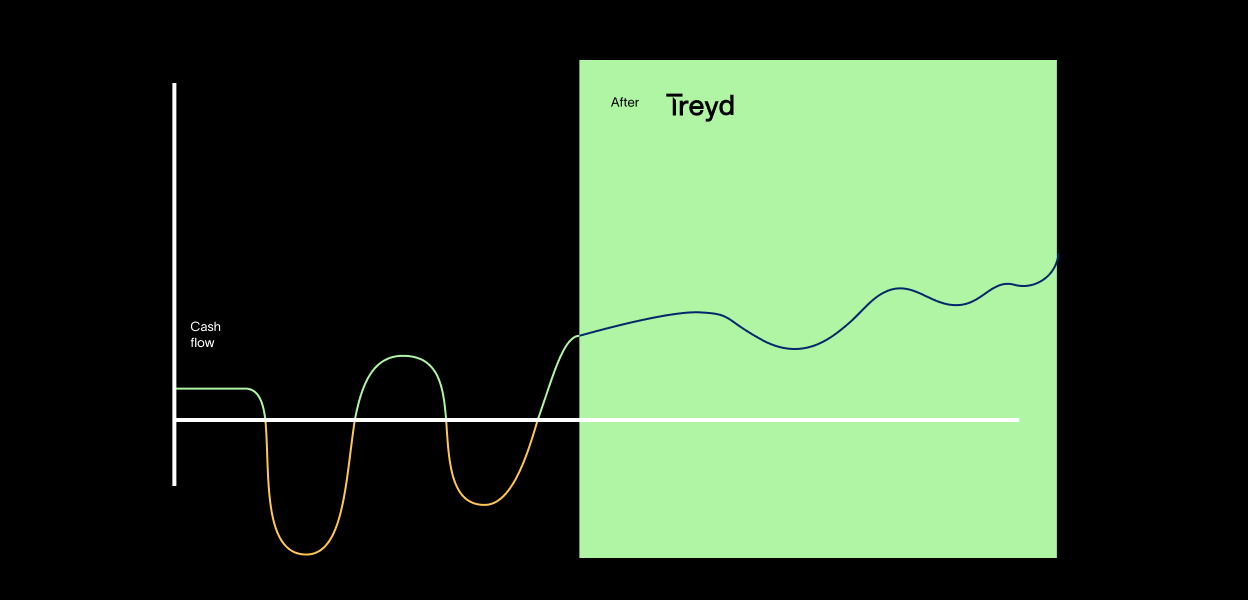

1. Improving cash flow

The most ‘basic’ of the use cases, this one perhaps doesn’t need much explanation. By using Treyd, you avoid taking big cash flow dips by tying up working capital in inventory.

Because you can pay for the inventory after it arrives and starts selling (instead of months in advance), you are able to maintain more steady cash flow levels, and keep capital on hand to invest in other areas of the business.

2. Bridging a liquidity gap

This may seem quite similar to the cash flow benefit above – but instead of a general improvement to cash flow, this use case relates to a more specific liquidity need, which can happen on a seasonal or occasional basis.

This use case is often a draw for larger companies. They might not struggle with working capital in the same way as a smaller business experiencing a growth spurt does, but they can still benefit from a liquidity bridge to give them a “breather” in times of increased costs.

An example would be a company looking to free up liquidity to invest in R&D, or a new product launch.

Even large, successful corporations occasionally need to bridge liquidity gaps in order to keep operations running smoothly – and one way to do this is by freeing up cash flow from inventory.

3. Expanding product portfolio

Speaking of new product launches, this is another frequent use case highlighted by customers. Growing companies that have found their groove with a hit product that sells non-stop often have difficulties branching out and expanding their portfolio.

This is because they rely on best-sellers to make money, but they need to keep making larger and larger orders of these popular products to keep up with demand, and their capital gets stuck in that loop.

This was the case for Collar of Sweden, who faced this challenge when looking to expand their product offering. Since each new product line came with a high minimum order quantity, they needed to pace their new product development as each order took up a significant chunk of their working capital. Something they were able to overcome with Treyd’s help.

4. Increasing order sizes

From what we’ve heard from customers, this is probably the second most popular use case for Treyd.

Because of the cash flow constraints caused by inventory purchases, many growing businesses opt to make smaller orders in a higher frequency, as they can’t afford to take bigger hits to their working capital – even though making larger orders would be economically favourable in many ways.

But by using Treyd to avoid getting their working capital tied down in inventory, taking the plunge to making larger orders becomes easier. This is the case for Strawbees, for instance, who reported having gained the courage they needed to increase order sizes because they were able to rely on Treyd.

The benefits that come with larger order sizes include better unit economics, as with larger orders comes a lower price per unit, as well as lower shipping costs. Which takes us to…

5. Switching to cheaper (and greener) freight options

Following from the above, one of the benefits that follow increased order sizes are decreased shipping costs. Especially if it means you make a large enough order to switch to a full container rather than a shared container.

But aside from that – Treyd can help customers lower their shipping costs even if their order sizes remain the same. This is because it enables the switch from air freight to cheaper (and greener) sea freight by removing the need for speed in deliveries.

This is because, while air freight is costly, it has the advantage of being fast. With the inventory arriving sooner rather than later, the time that working capital is tied up in inventory goes down – which is crucial when cash-to-cash time is a concern.

However, because Treyd lets companies defer their payment to suppliers by a few months, cash-to-cash time isn’t affected even if the inventory takes a few extra months to arrive using the slower sea freight shipping options.

6. Negotiating better supplier terms

Last but by no means least – using Treyd to make earlier payments to suppliers can give you a great leg up towards negotiating discounts.

This avoids the common tug-of-war that occurs in trade – with businesses pulling towards paying as late as possible on one end, and suppliers pulling to be paid upfront on the other.

With Treyd in the picture, however, both parties can get what they want. No struggle needed. With payment concerns gone, suppliers save a lot of time and effort and can skip the stress of extended credit terms. This in itself is enough to make them open to negotiating discounts.

In some cases, customers have reported that the discount they got from suppliers exceeded the fee charged by Treyd. Meaning, some companies can actually profit from using Treyd when they can use it to offer early payments. They get all the benefits of an early payment, without any of the drawbacks (as in: actually having to pay upfront).

As an added benefit – with early payments, you’ll have a better chance of getting priority service from suppliers, which can also add value to your business.

Bonus: improving margins

This one isn’t necessarily a use case in itself, but rather a knock-on effect brought with some of the use cases mentioned above.

With hefty supplier discounts, increased order sizes and lower shipping costs, price per unit can go down dramatically – meaning margins can go up significantly for each item sold.

In cases where customers are able to combine these use cases for their benefit, using Treyd becomes a no-brainer.

If one (or many) of these benefits sound promising, reach out to our team to chat more about how Treyd can help you improve several business outcomes – from cash flow to margins.